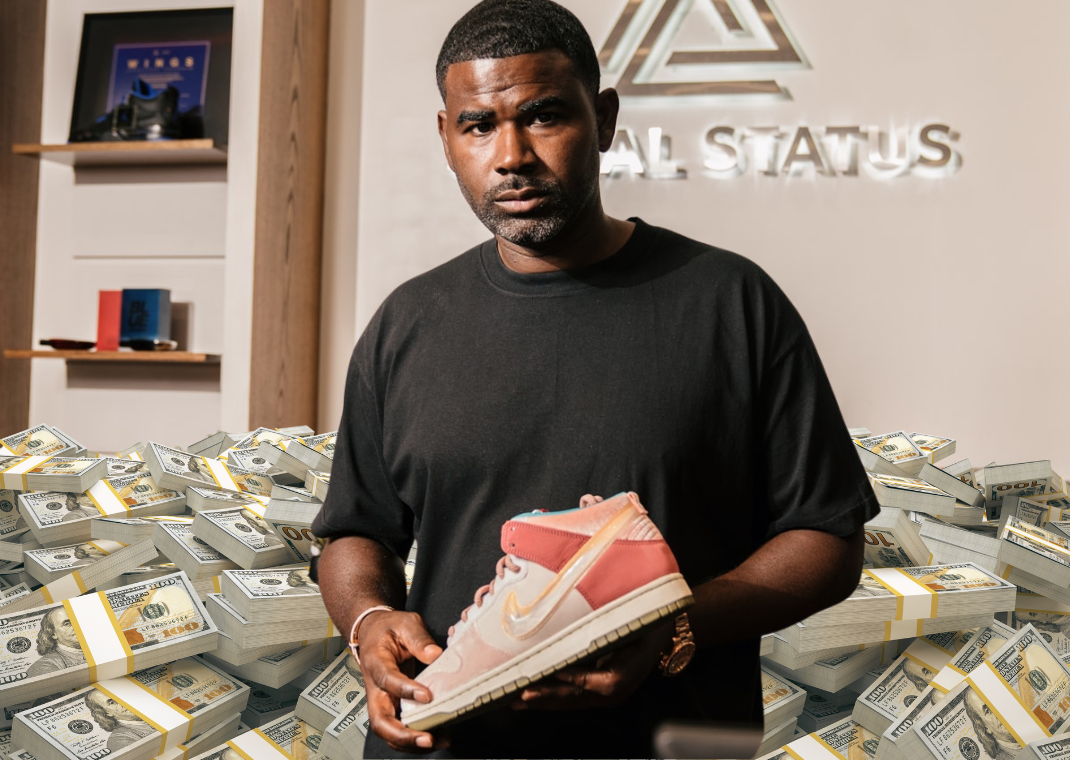

James Whitner of The Whitaker Group Named In Multi-Million Dollar Sneaker Money Laundering Scheme

Published

James Whitner has long been a revered name in the sneaker industry. Whitner is the visionary behind and owner of The Whitaker Group, an umbrella company that owns lauded stores like A Ma Maniere, Social Status, APB, and Prosper. Among the sneaker community, Whitner has been known as more than just a business owner; he's been a trendsetter, storyteller, and champion of the consumer. His collaborations with Nike and Jordan Brand, primarily through A Ma Maniere and Social Status, have yielded some of the most sought-after releases. However, a dark shadow has just been cast over Whitner’s illustrious legacy. According to federal court documents from the Western District of North Carolina obtained by Sole Retriever, James Whitner has been named in a civil complaint for forfeiture regarding a complex international money laundering scheme.

The news was first reported by WSOC-TV and was shared with Sole Retriever by @SneakerPhetish on X. Additional context regarding the ongoing legal proceedings was given by @SneakerLegal.

On Friday, November 17th, a civil forfeiture case was brought by United States Attorney Dena J. King and verified by IRS Special Agent Rajender J. West. The complaint seeks to claim approximately $1,199,530 in U.S. currency seized from Antwain Freeman’s apartment. Freeman has been cited as a mentor for Whitner, and the two’s relationship dates back to the mid-2000s when the first Social Status location opened in Pittsburgh. This is just the tip of the iceberg.

The complaint cites Whitner’s involvement in an unlicensed money-transmitting business (MTB) intertwined with various illegal activities. YG, a Chinese national referred to in court documents as a central figure in this scheme, allegedly distributed and sold sneakers and apparel in Asia and has been conducting business with Whitner since 2016.

In the documents, there are alleged to be more than 255 occasions in which Whitner, his businesses, and others involved received cash from YG. Each transaction totaled more than $10,000, which, under US law, requires special filing and a license to do. However, “none of the individuals or entities involved in the money movement properly obtained licensure or registered as a MTB with state or federal authorities.” These transactions totaled more than $32 million.

PNC Bank was handling a large amount of the deposited money. The financial institution questioned where the money was coming from, and Whitner advised that the money was “cash sales of sneakers and apparel at his stores throughout the country or from special promotional events.” Shortly after that, Whitner shifted his banking activities to South State Bank. Additionally, Whitner provided false information to PNC and South State Bank in connection with these cash deposits, which prompted the filing of false CTRs by each bank.

Whitner is also accused of violating contracts with sneaker companies, one of which is referred to in the court documents as “an Oregon-based manufacturer” (who is presumed to be Nike, although never explicitly named in the complaint), by reselling exclusive sneakers to unauthorized parties. This includes a Chinese retailer outside of the United States, to which Whitner and his businesses used code names such as “Nevada” and “Kansas” to refer to. The operation facilitated the movement of large amounts of cash, some of which derived from illegal activities such as narcotics operations and prostitution. The money subsequently was introduced into the banking system without proper reporting and regulations, a clear violation of the Bank Secrecy Act. The business conducted by Whitner, Freeman, and others involved in this scheme allowed them to profit from transactions that violated contractual agreements with “the Oregon-based Sneaker Company” and did so at the expense of violating U.S. federal law.

How the Money Laundering Scheme Operated

YG would purchase sneakers and apparel from Whitner, and then an individual referred to as “The Broker,” who was based in China, would receive payment from YG for the items YG was buying from Whitner. Money couriers would collect U.S. dollars and, once accumulating a certain amount of money, would deliver the funds to Antwain Freeman. Freeman, who was also not licensed or registered as an MTB, began to facilitate the handling of cash deposits in November 2019 after Whitner ceased his cash deposits in Charlotte.

The money was going through “The Foundation,” a brand development corporation operated by Freeman out of Manhattan, NY. Despite Whitner and an associate telling PNC Bank and Brinks that this business was part of Jaizai Investments (DBA The Whitaker Group), it was not a retail location for The Whitaker Group and did not conduct sneaker or apparel sales. Whitner’s false claims to financial institutions regarding the relationship between The Foundation and The Whitaker Group resulted in the banks filing BSA (Bank Secrecy Act) reports that contained material omissions or misstatements of fact.

Whitner allegedly would advise Freeman on when money was coming from Asian individuals in the New York area. After receiving the money, Whitner would direct Freeman on where to store the money, and Whitner or an associate would regularly follow up with Freeman to account for the money.

Whitner was notified when the cash was delivered, the amount of the cash received, what person delivered the cash, and what person received the cash. Whitner maintained a spreadsheet of these cash deliveries and the related information.

Despite these grave allegations, Whitner's impact on sneaker culture cannot be understated. His contributions have extended beyond commerce to influence design and trends within the industry. His role in creating the Nike Air Foamposite One Dream A World pack and iconic collabs like the A Ma Maniere x Air Jordan 3 showcases his deep involvement in product creation. However, this recent legal turmoil has cast a starkly different light on Whitner, contrasting sharply with his public persona.

Interestingly, on the Complex Sneakers Podcast, Whitner once discussed the ethical challenges facing store owners, expressing empathy for those compelled to backdoor sneakers due to financial hardships.

“I've had very candid conversations about the need for some stores to backdoor pairs. I'm not bout to tell nobody who's late on their rent not to do what they gotta do to make rent.” He continued, “If the market… is recessions happening, delays is happening, they're really doing the right things and the difference is like ‘Yo I'm gonna sell these three pairs of shoes to make this extra $1,800 because this is going to get me past my month’ man you better sell them shoes.”

His perspective, acknowledging the tough choices in a cutthroat market, now adds a layer of complexity to what is cited in Friday’s complaint. It raises questions about the lines Whitner may have crossed in his own business practices.

The allegations against Whitner underscore a potential industry-wide issue in the sneaker world. If proven true, they could dramatically affect Whitner's business relationships, particularly with Nike and Jordan Brand. His stores' ability to secure exclusive releases, the very foundation of their acclaim, could be significantly compromised.

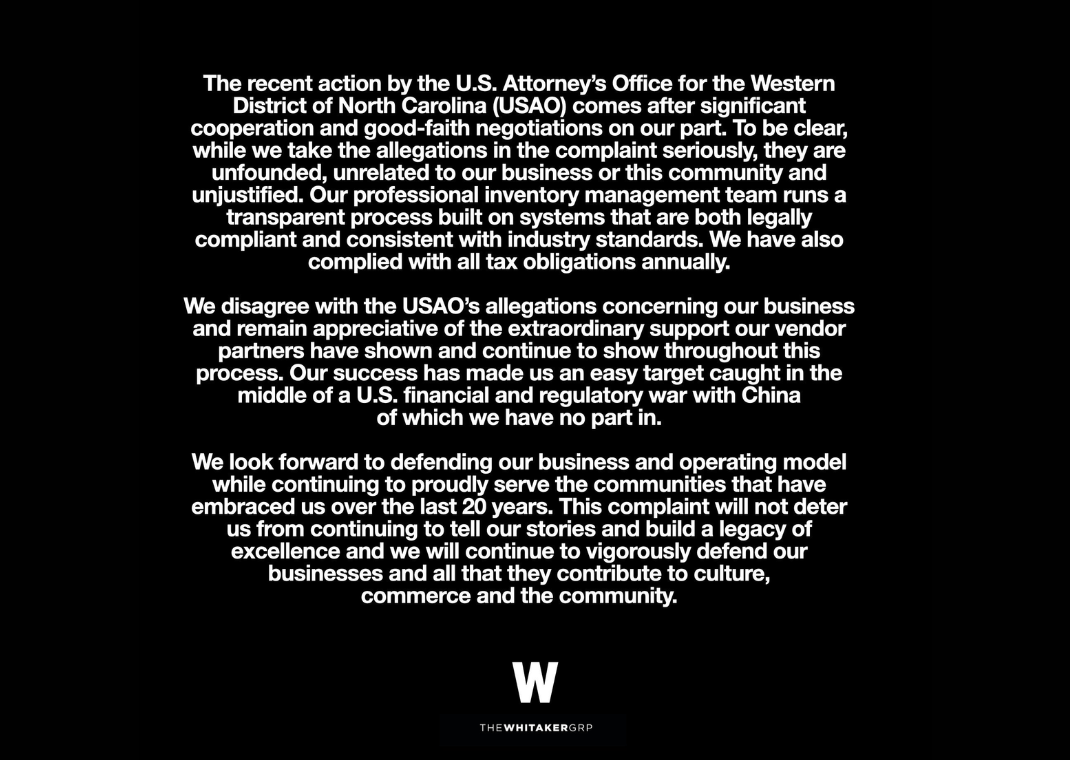

The Whitaker Group’s Official Statement Regarding The Money Laundering Charges

On November 21st, 2023, The Whitaker Group published the following statement:

“The recent action by the U.S. Attorney’s Office for the Western District of North Carolina (USAO) comes after significant cooperation and good-faith negotiations on our part. To be clear, while we take the allegations in the complaint seriously, they are unfounded, unrelated to our business or this community and unjustified. Our professional inventory management team runs a transparent process built on systems that are both legally compliant and consistent with industry standards. We have also complied with all tax obligations annually.

We have been a staple of the global business community for over 20 years, operating over twenty locations and employing over 250 employees across the country. Our work has been dedicated to helping people of color tell their stories and build a legacy of excellence. That work is now under attack, despite our best efforts at productive engagement with the USAO.

We disagree with the USAO’s allegations concerning our business and remain appreciative of the extraordinary support our vendor partners have shown and continue to show throughout this process. Our success has made us an easy target caught in the middle of a U.S. financial and regulatory war with China of which we have no part in.

We look forward to defending our business and operating model while continuing to proudly serve the communities that have embraced us over the last 20 years. This complaint will not deter us from continuing to tell our stories and build a legacy of excellence and we will continue to vigorously defend our businesses and all that they contribute to culture, commerce and the community.”

Based on the statement, it seems as though James Whitner is cooperating with authorities and planning to fight the allegations. Stay tuned as this story develops.

Fast Facts

- James Whitner, notable businessman and owner of The Whitaker Group, has been named in a civil complaint for forfeiture regarding money laundering

- This complex operation reportedly involved Chinese money couriers and a series of sophisticated financial transactions that flouted vital financial laws designed to prevent money laundering

- According to the complaint, Whitner broke at least one business contract with a sneaker company based in Oregon that explicitly forbids selling, shipping, or transferring its goods (sneakers) to other countries

- The business conducted by Whitner, Freeman, and others involved in this scheme allowed them to profit from transactions that also violated U.S. federal law

- Between November 2017 - April 2022, there are alleged to be more than 255 occasions in which Whitner, his businesses, and others involved received cash from a Chinese National named YG. These transactions total to $32 million

- The Whitaker Group issued a statement stating that it cooperating with authorities in their investigation and that the claims are unfounded

- At the time of this writing, James Whitner and The Whitaker Group have not been charged with any crime in connection with this federal complaint

Sneakerhead from South Florida who turned his passion into a career. When not writing for Sole Retriever, I enjoy attending concerts and catching the latest movies. Email: nick@soleretriever.com