How Much Does Nike Actually Make On Their Shoes?

Published

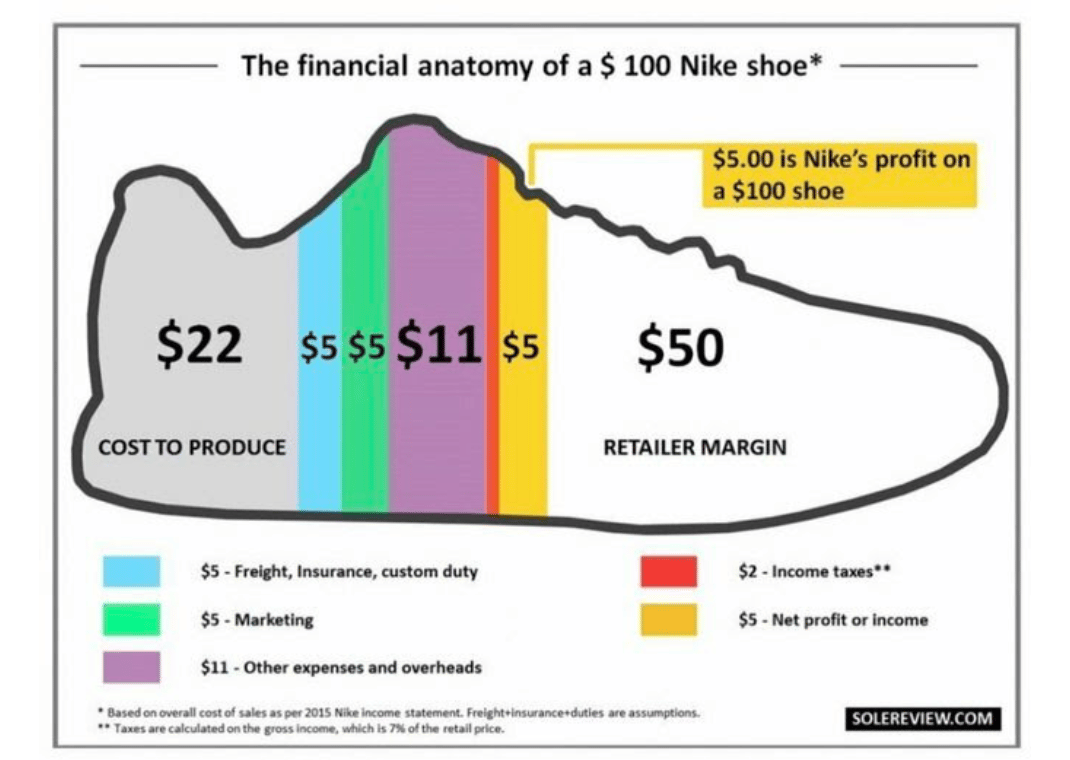

From humble beginnings selling products out of a van to the Oregon Ducks track team, Nike has grown into the largest sportswear brand in the world with a valuation upwards of $150 billion dollars. Obviously, as a business, investors need to be happy, profits come first, and production cost needs to be as low as possible while still maintaining the “quality” the brand is known for. One popular image that has floated around has shown the cost to produce an Air Jordan 1 being as little as $16.25, though this is from almost a decade back, and has caused consumers to gawk at the crazy margins the Swoosh must be making on these products. Well, according to a report recently shared by SneakerLegal that dates back to 2015, the actual profit margins for a $100 retail Nike shoe was only $5 per pair. Breaking down where each dollar spent by the consumer goes, $22 goes to production costs while $50 is given to the retailers carrying the shoe (a la Foot Locker, Finish Line, Champs). Surprising that the company producing and marketing the shoes was allowing these outside companies to rake in 10X the profits on Nike's sneakers.

To combat this, Nike has taken a turn to direct-to-consumer sales in recent years, reducing the number of wholesale accounts worldwide by 50%, mostly independent retailers. However, the larger players in this space still may feel the brunt of it considering 70% of Foot Locker's 2021 sales came from Nike products. This could spell disaster once The Swoosh has perfected its DTC methods.

While the numbers are from 2015, Nike's aggressive move toward DTC in recent years has likely increased the profit per pair dramatically. Let's face it, consumers are not heading to their local mall to purchase items in-store like they were pre-pandemic. Nike.com and SNKRS make it much easier for consumers to purchase direct by offering free returns, free shipping, and faster shipping than many of its retailers.

Even if Nike is still only making around 5% on average on its shoe sales, Macro Trends show that Nike as a whole makes around 13% profit margins aggregate across all products. Tie this to the fact that retail prices on sneakers like the AF1 have increased twice just this year with Nike's move towards direct sales, and it's obvious the brand is positioned to increase profit margins more so now than ever before.

Keep it locked to our Twitter and the Sole Retriever mobile app for more updates on the latest news, releases, and more in the sneaker and streetwear world.

Image via Sole Review

Sneakerhead from South Florida who turned his passion into a career. Concerts, music, trying new restaurants, and catching the latest movies are some of the things I enjoy when not writing for Sole Retriever. Email: nick@soleretriever.com