Golden Goose Still Chasing IPO

Published

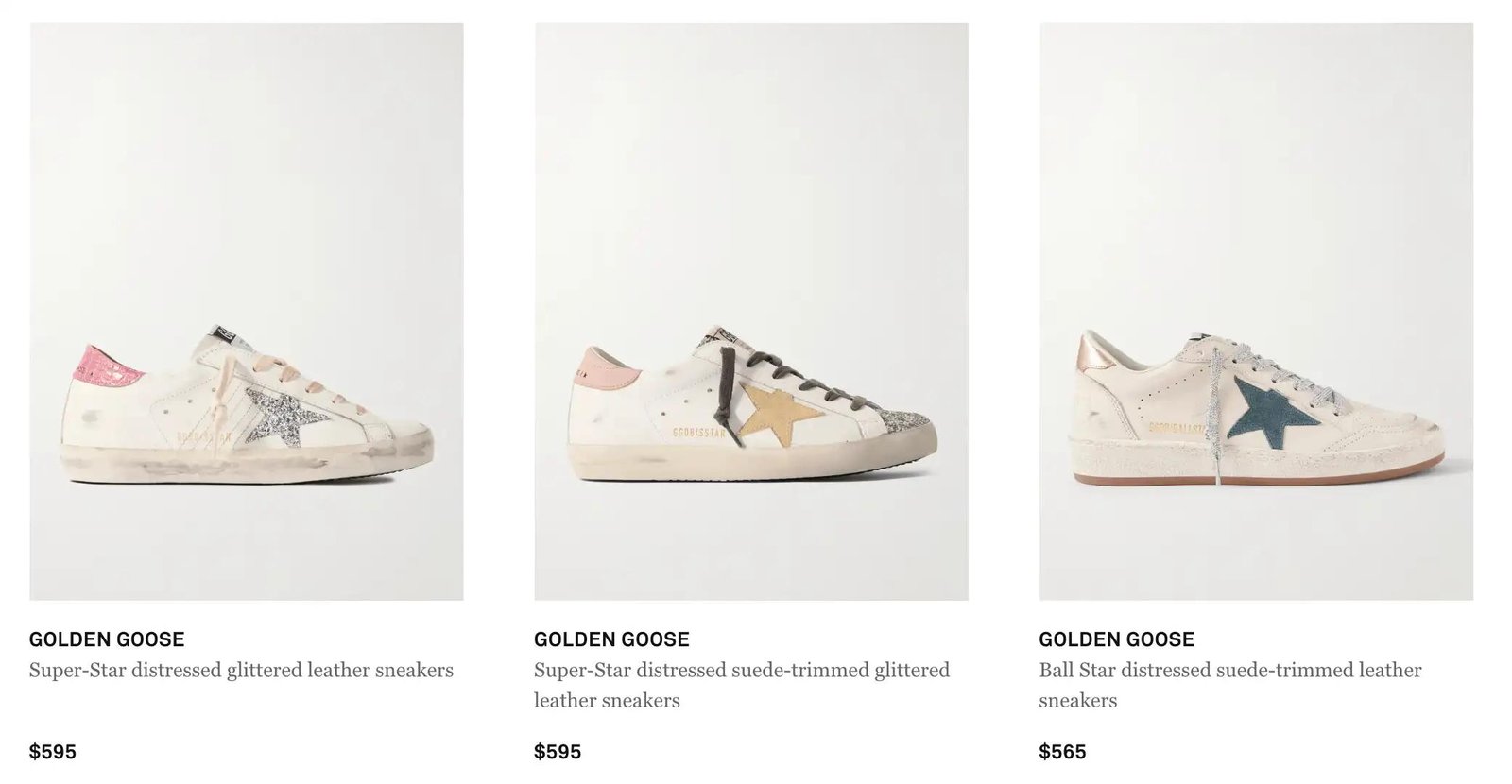

Golden Goose, the Italian luxury sneaker brand, has been making waves in the fashion world since its inception in 2000. Known for their signature "vintage finish", scuffed-up appearance, and high retail price, these sneakers have been embraced by celebrities and fashion enthusiasts alike. However, with the brand's recent announcement of plans to go public and subsequent postponement, many are questioning if Golden Goose sneakers are still cool or if they've reached their peak.

Golden Goose sneakers command a hefty price tag at the likes of Net A Porter, Farfetch, Neiman Marcus, etc., ranging from $500 to $900 per pair, although often they can be found on sale. Despite the high price tags, the brand has continued to grow, with net revenue increasing by 18% in 2023 compared to the previous year. The company has also expanded its reach by opening 21 new stores globally, focusing on direct-to-consumer sales.

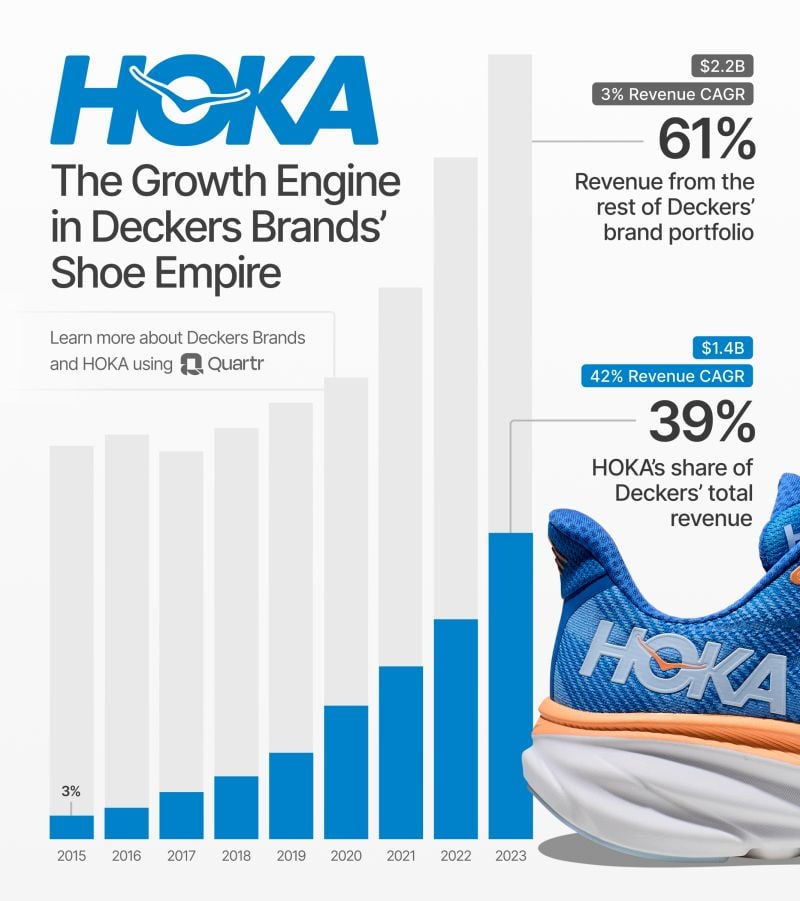

Golden Goose's decision to postpone its IPO comes at a time when several other sneaker brands have successfully gone public. In 2021, On Holding AG, the Swiss company behind the popular On Running shoes, raised $746 million in its IPO, valuing the company at over $7 billion. On's success was driven by its innovative designs, eco-friendly materials, and endorsements from high-profile athletes like tennis star Roger Federer. Similarly, in 2022, Hoka, a division of Deckers Outdoor Corporation known for its cushioned running shoes, filed for an IPO, capitalizing on its rapid growth and popularity among runners and fitness enthusiasts.

Golden Goose cited market deterioration following the European parliamentary elections and the calling of snap general elections in France as reasons for postponing its IPO. These events had a significant impact on markets and the luxury sector, including luxury clothing group Moncler, which saw its shares fall nearly 6% since the announcement of Golden Goose's IPO plans.

Despite the postponement, Golden Goose remains optimistic about its future prospects. The company reported that investors had been receptive during the IPO process and that its business continues to perform well. With asset manager Invesco acting as a cornerstone investor, Golden Goose stated it would consider reviving the IPO "in due course" when market conditions improve.

Prior to the postponement, the IPO was reported to be oversubscribed multiple times at 9.75 euros ($10.47) per share, with the price range initially estimated between 9.50 euros and 10.50 euros per share. Golden Goose, owned by private equity firm Permira, was aiming for a market capitalization of up to 1.86 billion euros, which was below expectations.

As the luxury sector continues to navigate ongoing market volatility and political uncertainty, it remains to be seen when Golden Goose will revive its IPO plans. However, the company's strong brand identity, loyal customer base, and solid financial performance suggest that it is well-positioned to capitalize on future growth opportunities once market conditions stabilize.

Cole Townsend is a developer, designer, and Head of Tech at Sole Retriever. He does some writing on top of helping keep Sole Retriever running on web and mobile! In his spare time, you can find him out running. Cole was a graduate from Williams College.